All Videos

Behavioral Finance

An amusing and whimsical look at behavioral finance best practices for investors.

Should You Tap Retirement Savings to Fund College?

There are three things to consider before dipping into retirement savings to pay for college.

Should You Ever Retire?

A growing number of Americans are pushing back the age at which they plan to retire. Or deciding not to retire at all.

Emerging Market Opportunities

What are your options for investing in emerging markets?

Social Security: By the Numbers

Here are five facts about Social Security that might surprise you.

The Other Sure Thing

A new LIMRA study shows that 40% of Americans believe the death of a primary wage earner would cause financial challenges.

16 Wall Street Cliches in 60 Seconds

Pundits say a lot of things about the markets. Let's see if you can keep up.

Retirement Accounts When You Change Your Job

This video discusses issues related to your retirement accounts when you move on from your job.

Bull and Bear Go To Market

Learn about the difference between bulls and bears—markets, that is!

18 Years Worth of Days

The average retirement lasts for 18 years. What will you do with your days?

How Cash Apps Work

Peer-to-peer payment apps are one of the newest ways to send money.

Top 5 Things to Tell Your Financial Pro

Here are the top 5 things your team may want to hear.

How to Bake a Pie-R-A

Roth IRAs are tax-advantaged differently from traditional IRAs. Do you know how?

Preparation is the Key to Retirement

The simplest ideas can sometimes make a massive difference over time. Enjoy this brief video to learn more.

Timing Your Retirement

This short video illustrates the importance of understanding sequence of returns risk.

What You Need to Know About Social Security

Every so often, you'll hear about Social Security benefits running out. But is there truth to the fears, or is it all hype?

Retirement Plan Detectives

Watch this fun video for tips on how to search for missing money.

Leaving Your Lasting Legacy

Want to do more with your wealth? You might want to consider creating a charitable foundation.

Dog Bites and Homeowners Insurance

Reviewing coverage options is just one thing responsible pet parents can do to help look out for their dogs.

Finding the Balance

The sandwich generation faces unique challenges. For many, meeting needs is a matter of finding a balance.

Retirement and Quality of Life

Asking the right questions about how you can save money for retirement without sacrificing your quality of life.

Dreaming Up an Active Retirement

When you retire, how will you treat your next chapter?

Encore Careers: Push Your Boundaries

Ready for retirement? Find out why many are considering encore careers and push your boundaries into something more, here.

Stay Safe with a B.O.P. At Your Back

Learn the advantages of B.O.Ps with this highly educational and fun animated video.

The Long Run: Women and Retirement

For women, retirement strategy is a long race. It’s helpful to know the route.

Surprise! You’ve Got Money!

Here’s a quick guide to checking to see if you have unclaimed money.

Tuning Your Social Security Benefit

When should you take your Social Security benefit?

Saving for College 101

Here's a crash course on saving for college.

The Latte Lie and Other Myths

Check out this video to begin separating fact from fiction.

It Was the Best of Times, It Was the Worst of Times

All about how missing the best market days (or the worst!) might affect your portfolio.

The Cost of Procrastination

Procrastination can be costly. When you get a late start, it may be difficult to make up for lost time.

When Special Care Is Needed: The Special Needs Trust

A special needs trust helps care for a special needs child when you’re gone.

Retirement Redefined

Around the country, attitudes about retirement are shifting.

Investments

You’ve made investments your whole life. Work with us to help make the most of them.

Extended Care: A Patchwork of Possibilities

What is your plan for health care during retirement?

A Fruitful Retirement: Social Security Benefit

Taking your Social Security benefits at the right time may help maximize your benefit.

From Boats to Brokers

From the Dutch East India Company to Wall Street, the stock market has a long and storied history.

Jane Bond: Scaling the Ladder

Agent Jane Bond is on the case, uncovering the mystery of bond laddering.

Jane Bond: Infiltrating the Market

Agent Jane Bond is on the case, cracking the code on bonds.

The Fed and How It Got That Way

Here is a quick history of the Federal Reserve and an overview of what it does.

How to Retire Early

Retiring early sounds like a dream come true, but it’s important to take a look at the cold, hard facts.

Keeping Up with the Joneses

Lifestyle inflation can be the enemy of wealth building. What could happen if you invested instead of buying more stuff?

Bursting the Bubble

Tulips were the first, but they won’t be the last. What forms a “bubble” and what causes them to burst?

Inflation and Your Portfolio

Even low inflation rates can pose a threat to investment returns.

The Real Cost of a Vacation Home

What if instead of buying that vacation home, you invested the money?

The Junk Drawer Approach to Investing

It's easy to let investments accumulate like old receipts in a junk drawer.

Global and International Funds

Investors seeking world investments can choose between global and international funds. What's the difference?

Are Alternative Investments Right for You?

With alternative investments, it’s critical to sort through the complexity.

The Business Cycle

How will you weather the ups and downs of the business cycle?

The Rule of 72

Do you know how long it may take for your investments to double in value? The Rule of 72 is a quick way to figure it out.

Safeguard Your Digital Estate

If you died, what would happen to your email archives, social profiles and online accounts?

What Smart Investors Know

Savvy investors take the time to separate emotion from fact.

The Power of Compound Interest

Learn how to harness the power of compound interest for your investments.

Retiring the 4% Rule

A portfolio created with your long-term objectives in mind is crucial as you pursue your dream retirement.

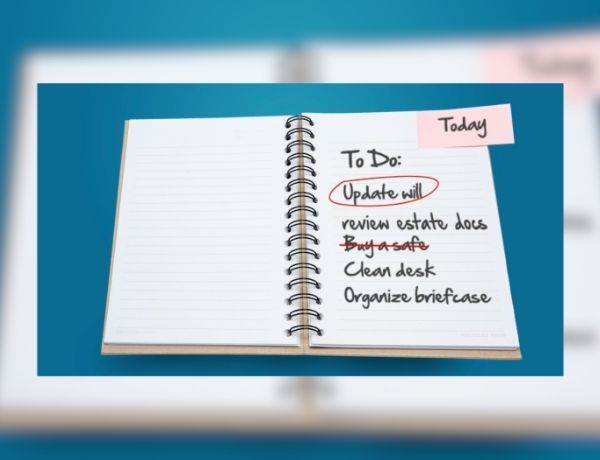

When Do You Need a Will?

When do you need a will? The answer is easy: Right Now.

Charitable Giving: Smart from the Heart

Do you have causes that you want to support with donations?

Estate Management 101

A will may be only one of the documents you need—and one factor to consider—when it comes to managing your estate.

What Can a Million Dollars Buy You?

$1 million in a diversified portfolio could help finance part of your retirement.

Your DNA Test

A Detailed Needs Analysis (DNA) can be a simple way to care for loved ones, no matter what the future may hold.

Making Your Tax Bracket Work

Have you explored all your options when it comes to managing your taxable income?

Exit Strategies of the Rich and Famous

Estate conservation is too important to put off. Do you have a smart exit strategy?

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG, LLC, to provide information on a topic that may be of interest. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.